Bank IFSC Code Details

What is IFSC Code :-

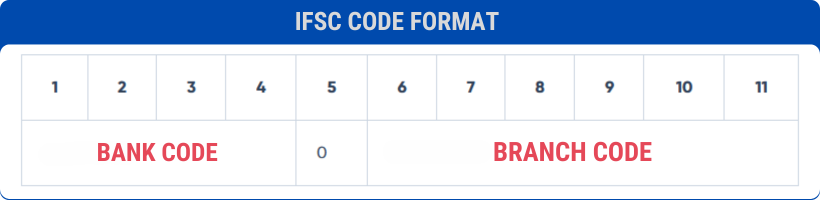

IFSC stands for ‘Indian Financial System Code’. It is a unique 11-digit alphanumeric code which is assigned to all the branches of all banks in India through Reserve Bank of India(RBI).

In IFSC code the first four characters represents the bank name, the fifth character is always zero, and the last six characters represents the branch code.

IFSC code is mainly used for paperless electronic money transfers between the banks, because it helps them to verify the transfer of money in between them.

IFSC code helps in identifying the unique number of the bank which is allocated to a perticular branch where the beneficiary account is located. It helps to identify the source and destination branchs of banks for online money transactions which are performed through National Electronic Funds Transfer(NEFT), Real Time Gross Settlement System(RTGS) and Immediate Payments Service(IMPS) transactions.

How to find IFSC Code :-

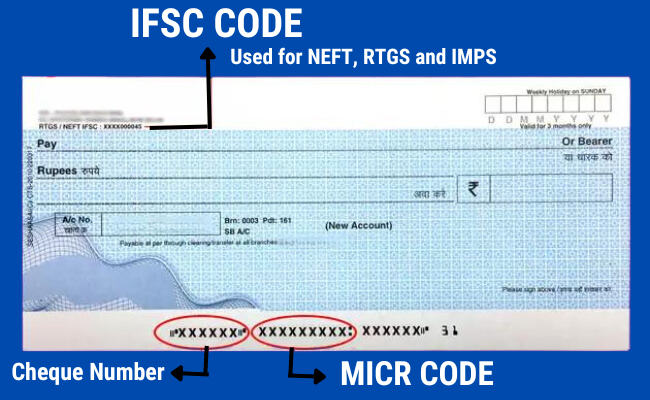

1. Cheque leaf :- The simplest way to find the IFSC code of any bank branch is to refer to your cheque book. The full address of the bank branch is located at the top left corner of a cheque leaf. At the end of the address you will find an 11-digit code which is your IFSC Code.

2. Passbook :- Refer to the front page of your passbook. It consists your account details and as well as your branch details. There you can find your IFSC Code.

3. Bank account statement :- Get the account statement from bank offline or online. Then in that statement you will find the complete details of your account and bank branch details including your branch IFSC code.

4. Contact your branch :- If you want to know IFSC code of your branch then simply call to the bank’s customer care number, then you will know the IFSC code.

5. Bank website :- Almost all the banks have ‘Branch Locator’ services available on their official website. You can now visit the bank’s official website and look for the ‘Branch Locator’ tool tab. Then click on the ‘Branch Locator’ tool and you will find the IFSC Code details of your branch. You can locate your branch and look for the required information on the branch.

6. RBI website :- Another way to find your IFSC code is to refer to the official website of the Reserve Bank of India(RBI). Go to the ‘IFSC codes’ tab. Here is an advantage if you know the name of your branch. Select your bank from the drop down menu and write the name of the branch. The website will give you the IFSC Code details for your branch. Otherwise if you don’t know the name of your branch. Once you choose the bank, the RBI shows a list of IFSC codes for all the branches of the bank. You can search for the branch and find the relevant IFSC code. Click here to go to the RBI website.

How to get IFSC Code from account number :-

According to the RBI guidelines, each and every bank is free to format its own structure for account numbers. As few banks use branch code as a part of the account number while others use some other format.

Your IFSC Code Can’t be determined by your account number.

For example, if you want to shift your branch from one area branch to another area branch.

In that scenario your account number will remain unchanged, while the IFSC Code associated with your account will change.

Therefore determining your IFSC code from your account number alone may not be a viable solution. Rather you can try the following ways instead :-

1. Check your IFSC code on your bank’s Cheque leaf.

2. Check your IFSC code on passbook or bank account statement.

3. Contact your branch.

4. Visit the bank’s official website and search for your branch’s IFSC code.

5. Visit the RBI official website and locate for your branch’s IFSC code.